Hello, fellow travelers! Today, I want to dive into a topic that’s close to my heart: balancing the thrill of travel with smart financial management. If you’ve followed my blog, you know that I love exploring new places while keeping my finances in check. Whether you’re a seasoned traveler or planning your first trip, these tips and insights will help you make the most of your adventures without breaking the bank.

Setting Financial Goals for Travel

Before you start planning your next trip, take a moment to reflect on your travel goals. Do you dream of hiking through the mountains, lounging on a tropical beach, or exploring historic cities? Prioritizing your travel goals will help you allocate your resources more effectively. For example, when I planned my trip to Palawan, I focused on budget-friendly activities like island hopping and snorkeling, which allowed me to experience the beauty of the Philippines without overspending.

Setting up a dedicated travel fund is one of the best ways to ensure you have the money you need for your trips. Start by determining how much you want to save and by when. Then, set aside a portion of your income each month. Automating your savings can make this process easier. Personally, I use a high-yield savings account specifically for travel, which helps my money grow while I save.

Budgeting for Your Trip

Understanding the costs associated with your destination is crucial for effective budgeting. When I traveled to Cebu, I researched accommodation options, local transportation, and food prices to get a realistic picture of my expenses. Creating a detailed budget helps you plan better and avoid unexpected costs. Remember to factor in everything from flights and accommodations to daily expenses and activities.

Saving on Transportation

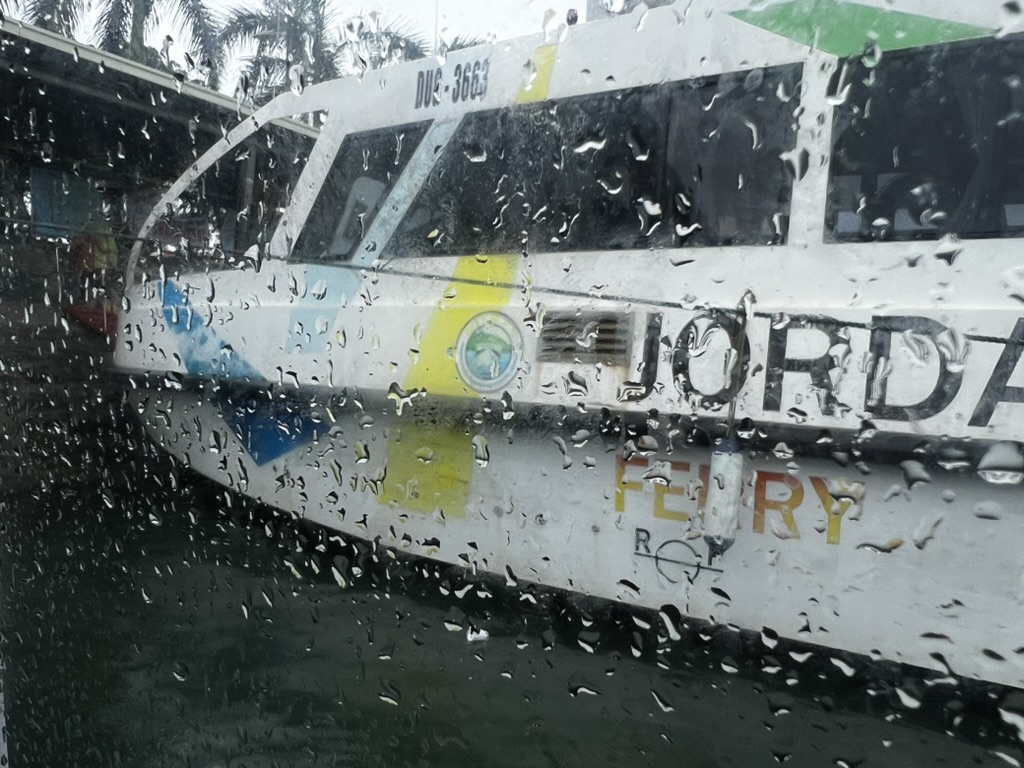

One of the biggest expenses when traveling is transportation. Booking flights in advance and being flexible with your travel dates can save you a significant amount of money. For my trip to Cebu, I monitored flight prices for a few weeks and booked when I found a good deal. Also, consider alternative transportation options like buses, trains, or even car rentals for local travel. In the Philippines, using jeepneys and tricycles is not only cost-effective but also a unique way to experience local culture.

Finding Affordable Accommodations

Accommodation is another major expense, but there are plenty of ways to save. Hostels, guesthouses, and budget hotels are great options for travelers looking to cut costs. During my travels, I’ve found that staying in locally-owned accommodations often provides a more authentic experience. Platforms like Airbnb and Couchsurfing can also offer affordable and unique lodging options. For example, in my frequent trips to Boracay, I have stayed in both budget hotels and homestays, which not only saved me money but also allowed me to immerse myself in the local culture.

Eating Well on a Budget

Food is an essential part of the travel experience, but dining out for every meal can quickly add up. Exploring local markets and street food is not only budget-friendly but also gives you a taste of authentic cuisine. In the Philippines, you can find delicious and affordable meals at carinderias (local eateries). When I was in Manila, I often ate at these places, enjoying dishes like adobo, sinigang, and lechon at a fraction of the cost of a restaurant meal. If you have access to a kitchen, consider cooking some of your own meals. It’s a fun way to try local ingredients and save money.

Managing Daily Expenses

Being mindful of your daily expenses can make a big difference in your travel budget. Small savings add up over time. For instance, instead of buying bottled water, I carry a reusable water bottle and refill it whenever possible. I also use public transportation or walk instead of taking taxis or rideshares. These small changes help me stay within my budget while still enjoying my trip.

Finding Free or Low-Cost Activities

Many destinations offer free or low-cost activities that are just as enjoyable as pricier options. Exploring parks, hiking trails, and public beaches are great ways to experience the local scenery without spending a lot of money. In Boracay, for example, I spent hours walking along White Beach and enjoying the beautiful sunsets at no cost. Similarly, visiting Puka Beach and Bulabog Beach provided serene and picturesque experiences away from the more crowded areas.

Making Extra Money While Traveling

If you’re traveling long-term or want to extend your trip, consider finding ways to earn money on the road. Freelancing, teaching English, or working in hostels are popular options. During my travels, I’ve met many people who fund their adventures through online work or short-term jobs. This not only helps cover travel expenses but also allows you to stay longer in the places you love.

Reflecting on Your Travel Spending

After each trip, take some time to reflect on your spending. What did you do well? Where could you have saved more? Keeping track of your expenses and reviewing them can help you improve your budgeting skills for future trips. I often jot down notes about my spending habits and any tips I’ve picked up along the way, which helps me plan better for my next adventure.

Personal Experiences and Tips

During my trips, I’ve learned a lot about balancing travel and finance. For instance, my adventure to Boracay was a perfect blend of budget-conscious choices and unforgettable experiences. I explored hidden barbecue spots that offered delicious meals at a fraction of the price of beachfront restaurants. One memorable dining experience was at Andoks, where the roasted liempo and chicken were both affordable and satisfying.

In Boracay, I also discovered the beauty of exploring off-the-beaten-path locations like Bulabog Beach and Puka Beach. These spots were less crowded and offered a more peaceful experience compared to the main White Beach. Staying in budget-friendly accommodations and eating at local eateries allowed me to extend my stay and enjoy the island’s natural beauty without worrying about overspending.

Another memorable trip was to Treasure Mountain in Tanay, Rizal. Camping overnight with my partner, we enjoyed the stunning views, cooked our own meals, and immersed ourselves in the tranquility of nature. The trip was affordable, and the experience of waking up to a panoramic view of the mountains was priceless. We also explored local coffee shops like Kape Natividad, which offered great food and a cozy atmosphere.

For a more detailed way to keep track of your spending and budgeting during your travels, I highly recommend using my travel expense tracker.

For those interested in creating their own adventures, I’ve written extensively about DIY Travel in the Philippines. This guide provides insights and tips to help you explore the beauty of the Philippines on your own terms, without the constraints of packaged tours.

Conclusion

Balancing travel and finance doesn’t have to be daunting. With careful planning, smart budgeting, and a bit of creativity, you can enjoy incredible adventures without compromising your financial health. Remember, the key is to prioritize your experiences, make informed choices, and always look for ways to save. Whether you’re exploring the stunning islands of the Philippines or venturing to new destinations, these tips will help you travel more and worry less about your finances.

Happy travels, and may your journeys be filled with unforgettable moments and smart spending!