Paying your SSS contribution is crucial, especially as you approach retirement age. If you’re 60 or older, you want to ensure you can enjoy your retirement comfortably. As a freelancer or small business owner, you might be wondering how to handle this without an employer to take care of it for you. Don’t worry; I’ve got you covered!

How to Calculate Your SSS Contribution

Calculating your SSS contribution might seem complicated, but it doesn’t have to be. To get the specifics, you can visit the SSS website and find all the details you need. However, if you’re like me and prefer a quick and easy solution, here’s an SSS contribution calculator for you. Just select your employment type and enter your monthly income to get your contribution amount.

SSS Contribution Calculator

How to Pay Your SSS Contribution Via Gcash

There’s a good reason why paying via Gcash is a good option. The service fee when paying via the SSS payment channel is PHP 98.00 versus Gcash which is only PHP 8.00.

Setting Up Your GCash Account

First, if you don’t have a GCash account, you’ll need to create one. There’s a helpful guide here to walk you through the process. Once you have your GCash account set up, you’re ready to go!

Using the SSS Portal

1. Log In: Go to the SSS Member Portal and sign in to your account. If you don’t have an account yet, you can sign up here.

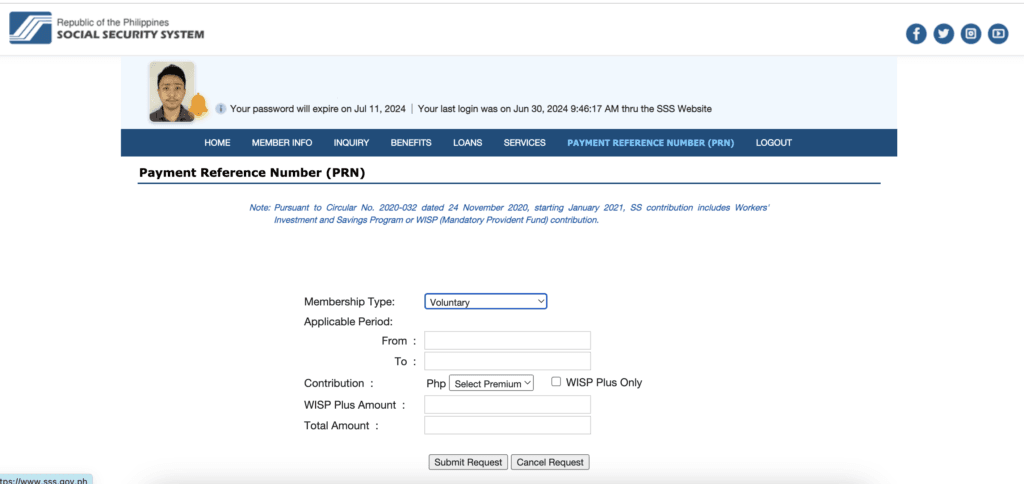

2. Generate PRN: Once logged in, navigate to “Payment Reference Number (PRN)” in the menu.

3. Create PRN: Hover over “Contributions” and select “Generate PRN” from the dropdown. You’ll be redirected to a form.

4. Fill Out the Form: Complete the form to generate your PRN.

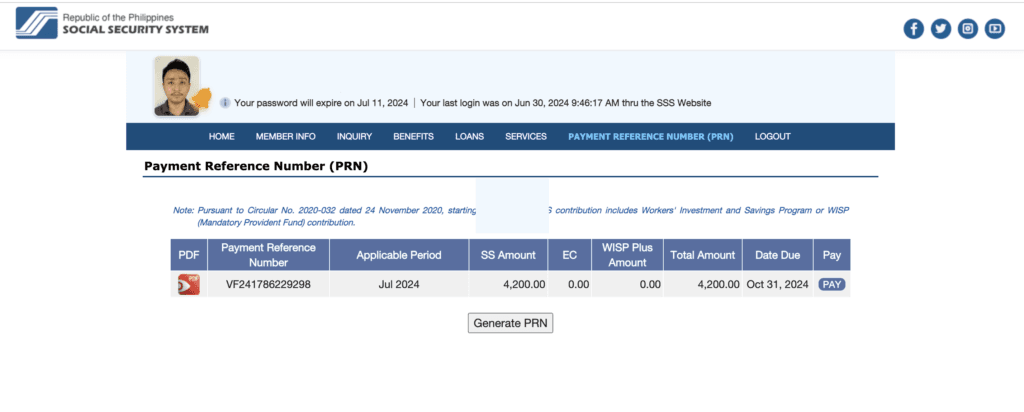

5. Save Your PRN: After generating, you’ll be redirected back to the PRN Generator page where you can see your PRN. This number is essential for making your payment via GCash.

6. Optional Payment: If you prefer, you can use the pay button on the screen to pay directly instead of using GCash.

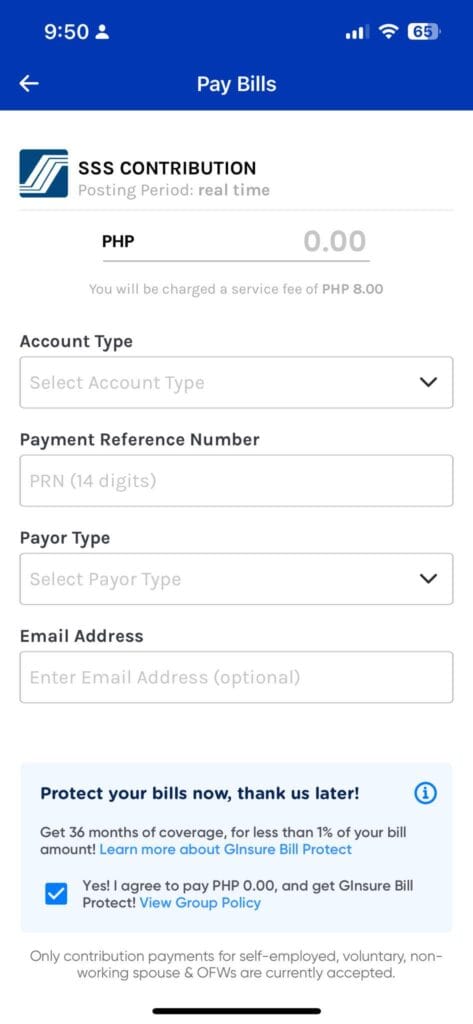

Paying with GCash

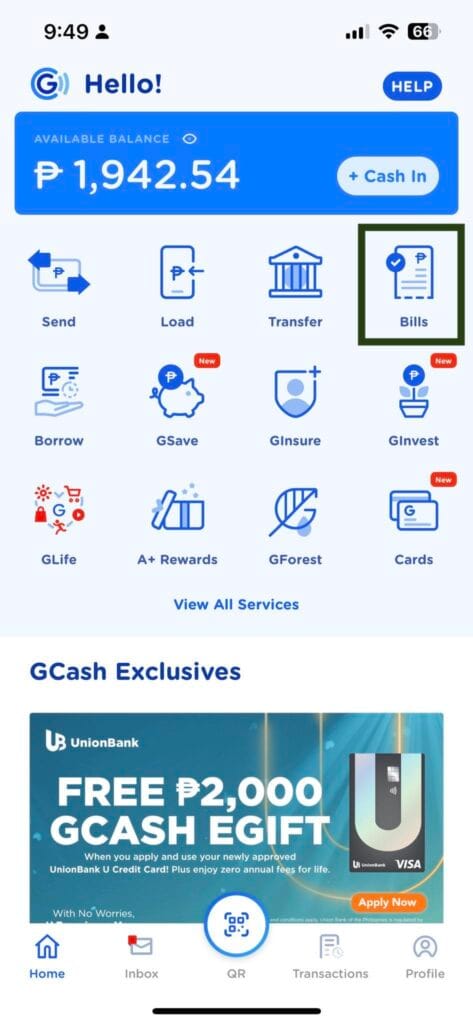

1. Log In: Open your GCash app and log in.

2. Select Bills: Click on the “Bills” option.

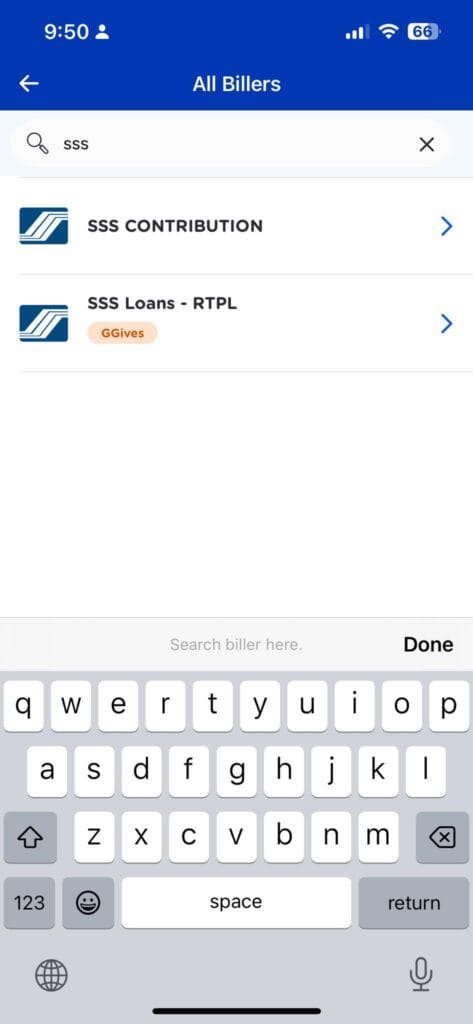

3. Search for SSS: Type “SSS” in the search bar and select “Contribution” from the results.

4. Fill Out the Payment Form: Enter the required details, including the PRN you generated from the SSS Member Portal (example: VF241786229298).

5. Complete the Payment: Follow the prompts to complete your payment. I recommend saving a screenshot of your payment confirmation for your records.

6. Verify Payment: Check your SSS Member Portal to ensure your payment has been reflected.

And that’s it! You’re done!

Got Questions?

If you have any questions or need further assistance, feel free to reach out. I’m here to help make the process as smooth as possible for you. Paying your SSS contributions doesn’t have to be stressful, and with these steps, you’ll be well on your way to securing your future. Happy freelancing and good luck with your business!

7 thoughts on “How to Pay SSS Contribution for Freelancers and other Employment Types”

Great weblog right here! Also your site a lot up fast!

What host are you using? Can I get your affiliate link to

your host? I want my website loaded up as quickly as yours lol

This paragraph presents clear idea in favor of the new

visitors of blogging, that truly how to do blogging and site-building.

Have you ever considered about including a little bit more than just your articles? I mean, what you say is important and everything. However think of if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with images and video clips, this blog could undeniably be one of the very best in its field. Terrific blog!

Hey there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no backup. Do you have any methods to protect against hackers?

Hi to all, the contents existing at this website are in fact amazing for people experience, well, keep up the nice work fellows.

It is appropriate time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I want to suggest you some interesting things or advice. Maybe you can write next articles referring to this article. I wish to read more things about it!

What’s up to all, the contents present at this web page are genuinely amazing for people experience, well, keep up the nice work fellows.